The real engine is something far less glamorous, but far more powerful: tax relief for early-stage investors.

SEIS & EIS tax relief schemes for angel investments

More than 90% of all angel investments in the UK are made under the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS). These schemes incentivise UK-based investors to strategically and systematically back risky young companies – by offering tax relief both on the amounts they invest and on their losses if a startup fails.

- Founders can access money that simply would not exist without tax relief.

- Investors can reduce risk enough to make early innovation a rational asset class, not a charity or gamble.

This predictable, government-backed incentive has made the UK one of the most consistently liquid early-stage markets in the world. And shows to policy-makers that tax incentives – when engineered well – can generate a sustained flywheel of innovation.

What types of companies can you invest in under SEIS & EIS?

- SEIS is aimed at delivering seed capital to UK-based, unlisted early-stage companies in eligible trades that have been trading for no more than two years, have fewer than 25 employees, and have assets under £350,000.

- EIS is designed for somewhat more mature eligible companies, typically trading for less than 7 years, with fewer than 250 employees and 15 million pre-money assets and allows for larger investments, with an annual fundraising limit of up to £5 million, and a company lifetime limit of £12 million.

Which tax reliefs do SEIS & EIS offer?

UK government-endorsed SEIS & EIS schemes offer a range of tax reliefs to UK-based angel investors when they invest in eligible UK early-stage companies. This includes income tax relief, Capital Gains Tax (CGT) exemption after holding the investment for three years, and loss relief, which allows angel investors to offset losses against CGT and income tax, reducing the financial impact of unsuccessful ventures on their early-stage investment portfolio.

- SEIS offers individual investors 50% income tax relief on investments up to £200,000 per tax year.

- EIS provides 30% upfront income tax relief for investments up to £1,000,000 annually (or 2 million for knowledge-intensive companies).

How to make the most of SEIS & EIS?

UKBAA recommends that angel investors:

- Diversify investments across a portfolio of various companies to spread risk.

- Adopt a long-term investment approach, and be prepared to hold the investment for at least 3 years.

- Utilise the EIS loss relief provisions for unsuccessful investments.

- Take a portfolio approach to maximise the benefits of loss relief. Even if the portfolio returns an overall commercial gain, the EIS angel investor can still get loss relief on their unsuccessful investments.

- Leverage carry-back relief to apply the current year’s investment against the previous year’s tax.

- Stay informed about changes in legislation and scheme details.

We’d also recommend making sure that your investee companies understand their role and responsibility in ensuring and maintaining their eligibility, and initiating the tax relief application process.

Risks for investors and founders – and why trust matters

EIS/SEIS is not just a tax vehicle – it’s a trust system. When it works, angels can invest with confidence, and founders can secure capital they might otherwise never access. When it fails, it creates irreparable damage: investors lose their tax relief, and founders lose their reputation and future access to capital.

It’s crucial that both sides understand the risks and the division of responsibility.

The majority of the operational burden sits with the company – not the investor – and first-time founders often do not fully understand this until it is too late.

Here are the main risks related to SEIS/EIS systems and why mutual understanding matters.

Risk #1: not understanding “advance assurance”

83% of UK angels invest through EIS, and understandably, investors want reassurance that the deal will qualify. For that, you can obtain advance assurance from HMRC before issuing shares.

Advance assurance:

- does not guarantee final eligibility

- but it is often required by investors before committing funds,

- and helps resolve disqualifying issues before moving money.

Processing the application takes time, and HMRC evaluates risk differently than investors do. In 2024 – 2025, there were 3,090 EIS advance assurance applications with a 76% approval rate, and 3,195 SEIS applications with an 85% approval rate – a high but not automatic success rate.

Risk for investors: committing capital before assurance is confirmed.

Risk for founders: applying too late or assuming eligibility without checking. You should apply for advance assurance before your investors ask you for it and follow the process carefully.

Risk #2: founders don’t understand the work they have to do after the investment

Many founders think advance assurance is “the EIS process”. It is not. The real work for tax relief begins after the round closes and shares are issued.

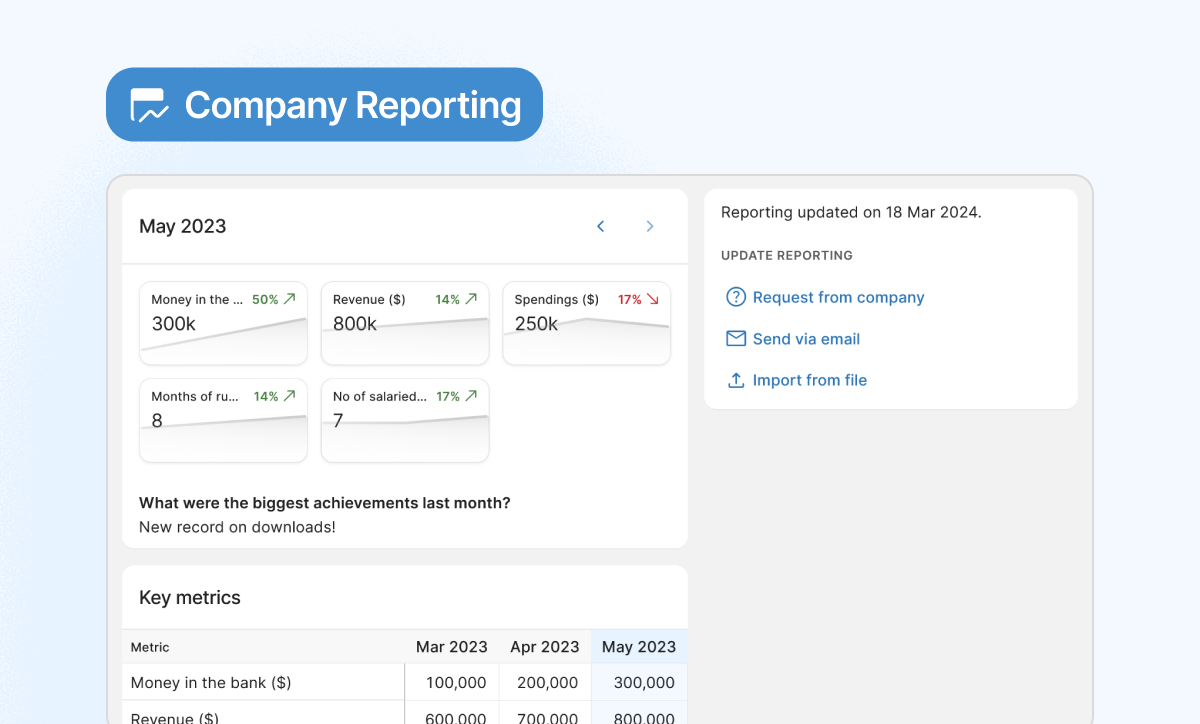

The company must start the compliance process, so the investors can claim relief. The key milestone is the EIS1 compliance statement, which lists all investors and can only be submitted after a minimum of 4 months of qualifying trading. This must be done for every share issuance.

If advance assurance was obtained earlier, any changes must be reported; if not, the company must supply a full new application, including business plan, forecasts and risk justification.

Risk for investors: if the founder fails at this stage, the investors lose the expected 30–50% tax relief – after they have already committed the money.

Risk for founders: it’s a catastrophic start to founder-investor relations. And it’s the kind of reputational mistake a founder doesn’t get a second chance to fix.

Risk #3: handling certificates and staying compliant in the long term

Once HMRC approves the EIS application, the company is authorised to issue EIS3 certificates to investors. These certificates are critical for the investors and their accountants to claim and retain the tax reliefs.

And they need to be at hand when tax filing season gets underway in October and November. No certificates, no relief.

Additionally, EIS/SEIS compliance is not “one-and-done”: If the company breaches rules within 3 years, HMRC can withdraw the relief retrospectively. So the founders need to make sure everything is in order, properly recorded, and ready for enquiries for tax filing.

Risk for investors: if the company doesn’t provide the certificates, fundamentally changes its trading operations or otherwise breaches or breaches rules within 3 years, HMRC can withhold the relief or withdraw it retrospectively.

Risk for founders: if you can’t abide by the rules for at least 3 years post-investment, your investors lose their tax relief, damaging your reputation and investor relations.

Risk #4: including the wrong instruments, share classes, or investors

SEIS and EIS tax relief only applies to full risk, newly issued ordinary shares or non-cumulative, fixed preference shares. No linked loans (such as convertible loan notes) are allowed, and there can be no special protection rights offered to shield investors from risk. The shares must be subscribed for in cash and fully paid up at the time of issue.

To maintain eligibility, the portfolio company must maintain their qualifying status and spend its investment on eligible activities. The company must have a permanent establishment in the UK, and an essential and substantial part of the business must be carried out in the UK, whether this is a physical site or the main market.

As the aim of the EIS is to attract external investors, the scheme denies relief to investors who are ‘connected’ with the company – including employees, directors, or investors who (alone or with associates such as spouses, business partners or lineal relatives) hold more than 30% of the share capital. There are provisions for Business Angels to later become directors, but founders should be careful so this doesn’t affect eligibility or cause a loss of tax relief.

Risk for investors and founders: a single ineligible participant or instrument can disqualify part or all of the round

How to mitigate these risks?

As you can see, there’s a lot at stake and the investors really need to put their faith in the founders’ ability to see the SEIS/EIS process through. And the founders need to understand the steps and deadlines of the process, as well as the seriousness of their obligations. If they let down their investors once, they probably won’t get a second chance.

How Dealum can help mitigate risks, & help manage SEIS/EIS processes both before and after investment

The practical risks around SEIS/EIS rarely come from tax rules themselves – they come from lack of knowledge, inadequate processes, lost documents, incorrect declarations, and timing errors.

Dealum is used by angel syndicates, individual investors and specialist fund managers, and is designed to reduce those risks at every stage – before commitment and after investment – by structuring information, documentation and communication in one shared environment.

For angel investors

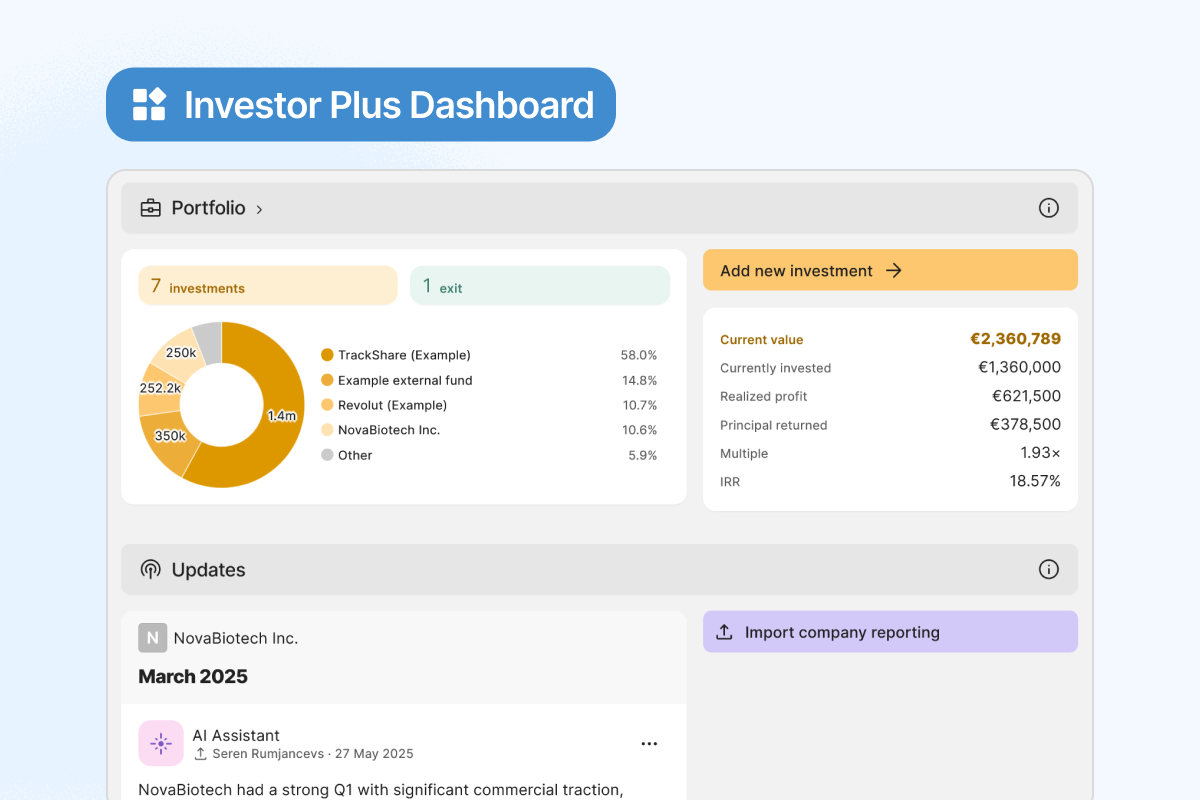

Dealum’s Investor Plus supports investors who take a portfolio approach, providing the tools you need to manage and understand your early-stage portfolio in one place:

- Automated import of company documents and reporting;

- AI-assisted insights on company performance and updates;

- Central storage for all investment and SEIS/EIS documents;

- See at a glance which companies are fulfilling post-investment reporting and which are not.

This reduces the single biggest investor-side risk: not knowing if the founder is on track to complete the filings that make tax relief possible.

For business angel networks (BANs)

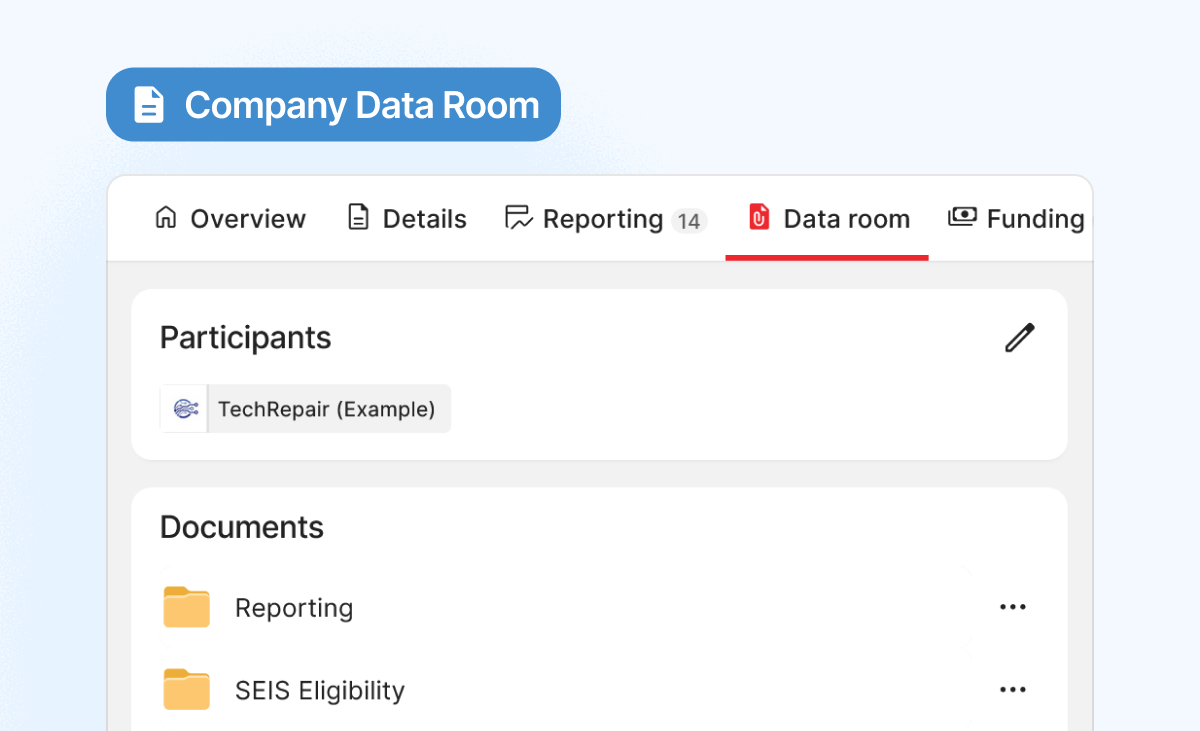

Dealum helps BANs collect and store relevant information with structure:

- Ask questions about SEIS/EIS eligibility at the application stage to qualify deal flow early;

- Store all share certificates, EIS/SEIS approvals and round documents centrally;

- Allow members to retrieve tax season documentation from Dealum, instead of contacting founders separately.

This solves the common post-round problem when individual angels need to chase founders for missing documents.

For startup founders

If your investors use Dealum to manage the investment round, you can share all relevant reporting and documents with them. This helps you throughout the two critical stages.

Before investment (screening and diligence)

- When you apply to a dealroom/investor, pay careful attention to their SEIS/EIS eligibility questions and answer them accurately.

- Never claim to be EIS eligible if you’re not sure.

- Don’t claim you have EIS advanced assurance if you haven’t completed the process – it may take longer than you think.

Immediately after investment (the most time-sensitive phase)

Your most important EIS responsibilities happen immediately post-investment, once you issue your shares. First, you need to initiate the claim process for all your angel investors by completing the compliance statement. Once the EIS status is approved by HMRC, you need to issue the EIS certificate details to your individual angels. There are a number of related tasks happening at once and you can’t be too organised at this stage.

You can use Dealum to:

- Circulate EIS3 certificates once approved;

- Keep a record of completed related statutory tasks (e.g. SH01 for share allotments);

- Keep investors informed to reassure them that their tax relief is being secured.

Dealum is not just a place to upload a pitch deck. Your EIS reporting responsibilities continue for years after you close the round. Dealum helps you and your investors stay connected and manage the continuous reporting.

The bottom line – Dealum helps all parties mitigate SEIS/EIS risks by preventing lost files, sequencing errors and miscommunication that typically cause tax relief failures.

Want to see how Dealum simplifies SEIS/EIS management?

Book a short demo to learn how UK angel groups and funds use Dealum to track eligibility, manage documents, and streamline post-investment compliance.

Book a demo