The process of comparing and finally selecting a SaaS platform to manage an angel or investor network can be viewed by some as quite a daunting and strenuous task. In fact, one which many network managers would hope to make only once every 5 or 10 years. However, digital transformation has been lusted upon us and early stage investing is evolving so there couldn’t be a better time to review what’s out there. We’ve put together a comparison of the available systems designed to help you do your job more efficiently.

Firstly, it’s important to recognise that choosing a software is a multi-layered decision process with consequences, good or bad, which can have a direct impact on others, especially if it leads to a less than satisfactory outcome. Selection of the digital framework helping high-worth individuals to engage with their investments definitely falls into the tricky category.

But even before you, the network manager, engage with software vendors, it’s crucial that you have a clear understanding as to why and what the group needs. More so as you will be investing a lot of your own and colleagues' time in the process.

Some of the most valuable questions BAN managers can ask are:

- Where are the bottlenecks in our current processes?

- How could software help run our network better?

- What software(s) would we like to replace, and why?

- What do our members think of our current digital set-up?

- What are the main restrictions our current tech stack has on our network?

- How can we use technology to improve the quality of our deal flow?

In our experience, the framework of the selection process can typically be categorised into five stages:

- Status quo

- Identifying the problem

- Understanding requirements/options

- Engaging with vendors

- Making the decision

As you can imagine, this can become quite an elongated process. Complexities can arise at any of the above stages which can indeed make the whole experience quite unrewarding, should you eventually choose a system that doesn’t meet what you originally set it out to do.

When speaking with our customers, it surprises us how many had become accustomed to patching multiple systems together in order to create the end to end solution they crave. An example of that being one customer who joined our platform last year and had 30+ software subscriptions in place to manage their 400 strong network of angels.

The clear downside to multiple tools is having a saturated technology stack that creates gaps in processes and ultimately leaves members forgetting log-in details or giving up on using it all together. And, not to mention the cost attached - both both in terms of time and the subsequent (multiple) fee(s) attached. Nevertheless, when met with a complete, intuitive, well thought out solution it can be a very refreshing and rewarding experience - coupled with a consultative conversationalist who can listen to your requirements and elaborate how certain features could achieve those... you can actually begin to get excited about what is to come.

Now, let’s take a step back. You’ve recognised that there is a need to unite and enhance your angel network. What software options do you have in 2021? Let’s explore those we most commonly hear of.

1. Gust

If you have been involved in angel investing at all over the past 10-15 years, we can safely assume that you’re pretty familiar with Gust. Founded in 2004, they are recognised as the industry standard for angel and venture associations and provide a system for hundreds of groups worldwide to manage their investment process. In doing so, Gust has built one of the world’s largest communities of entrepreneurs and early-stage investors stretching across 191 countries.

Regarding platform functionality, Gust provides a system for groups to capture deals, process them through a work-flow and collaborate with partners somewhat. For entrepreneurs, Gust provides the complete tool set for professional investor relations from pitch to exit. The platform itself has been largely adopted at no cost for most of the groups and with the free pricing model, it's no surprise that the solution hasn’t been developed further for some time now.

Nevertheless, for many angel groups across the world Gust acts as the backbone to their operations and suits their budgetary constraints. Plus, having been operating in a somewhat monopolistic market for some time, Gust users have found comfort in the approach “If it’s not broken, why fix it”? Which we’re not knocking in the slightest. However, with the rapid evolvement of technology, it poses the question - if the platform isn’t improving for angel groups, could network managers fall behind and end up missing out on quality deal flow as a result?

2. Proseeder

As described on their website, the Proseeder platform “empowers corporations with adaptive tools for collaboration, diligence, and execution quantifying strategic ROI of investments & partnerships that supercharge corporations efforts to innovate iteratively”. Founded in 2014, Proseeder has grown to become a recognisable brand, predominantly in the U.S. but also further afield as they expand their offering.

Having begun their journey focusing on early stage markets, Proseeder shares a big percentage of the market when it comes to angel groups. The platform provides a place for groups to engage with startups, manage members, and execute on deals. As the years have passed, Proseeder and their founder Ken Gatz have been open and transparent in that their vision has somewhat angled away from angel investing. This is not to discredit the role angels play within the investing ecosystem, but how their technology is expanding in the direction of Corporate Venture & Development.

Nevertheless, more angel groups are being formed at an encouraging rate and the driving force behind that is the next generation of high net-worth individuals who naturally have a clear understanding of the technological landscape. The latest trend within the venture capital world is that there is a shift of moving towards the earlier phases of a company, meaning that The Future of Angel Investing could have multiple players. If this is the case, would their software requirements be the same?

3. Dealum

Let's start with some company background as it plays a critical part in illustrating where we sit within the marketplace. Founded in 2017 by Rain Kivisik and Rein Lemberpuu, successful founders and active angel investors, Dealum was born out of a vision to streamline the early-stage investing. Both founders recognised an opportunity to create a better experience and Dealum has been designed to supercharge cross-border cooperation and the sharing of deals between investors and networks. As such, our team has worked closely with key players to design a feature rich, intuitive system that meets the needs of a modern day angel group.

The range of functionality built into Dealum’s deal room is substantial and very detailed. The areas we’ve focused on begin at deal sourcing, application & funnel set-up and stretch all the way through to member, portfolio & event management, with everything in between. The reason behind providing such a comprehensive feature set is the proactive relationship we have with our clients - with a designated account manager, each of our customers has a clear path through to the development arm of Dealum. This collaborative relationship is what has led us to integrate with the likes of Docusign, Stripe & Zapier. What we have found is that if a feature request makes sense for one or two of our clients, the likelihood is that it will for others and therefore we take every piece of feedback very seriously.

Angel investing in general is quite a traditional space and many are content with the processes in place. It’s also difficult to meet the varied needs of every group. Furthermore, a lot of the angel networks we speak with ask for an assurance that our longer term plans wouldn’t deter to a more profitable route further down the line. This is a valid concern considering there can be a mass amount of data stored in a network management system leading to a complicated migration process which is better avoided. A confidence that the software will cater to angel group's needs in the long run is essential.

The answer we give to angel groups lies within our long-term ambition which is the driving force behind our product roadmap and evolving value offering:

To become the leading global deal-flow source for early-stage investors by creating meaningful connections between investors and startups.

Our software service is deal flow management combined with a digital community to aid the creation of new networks as well as trust between investors and networks across borders.

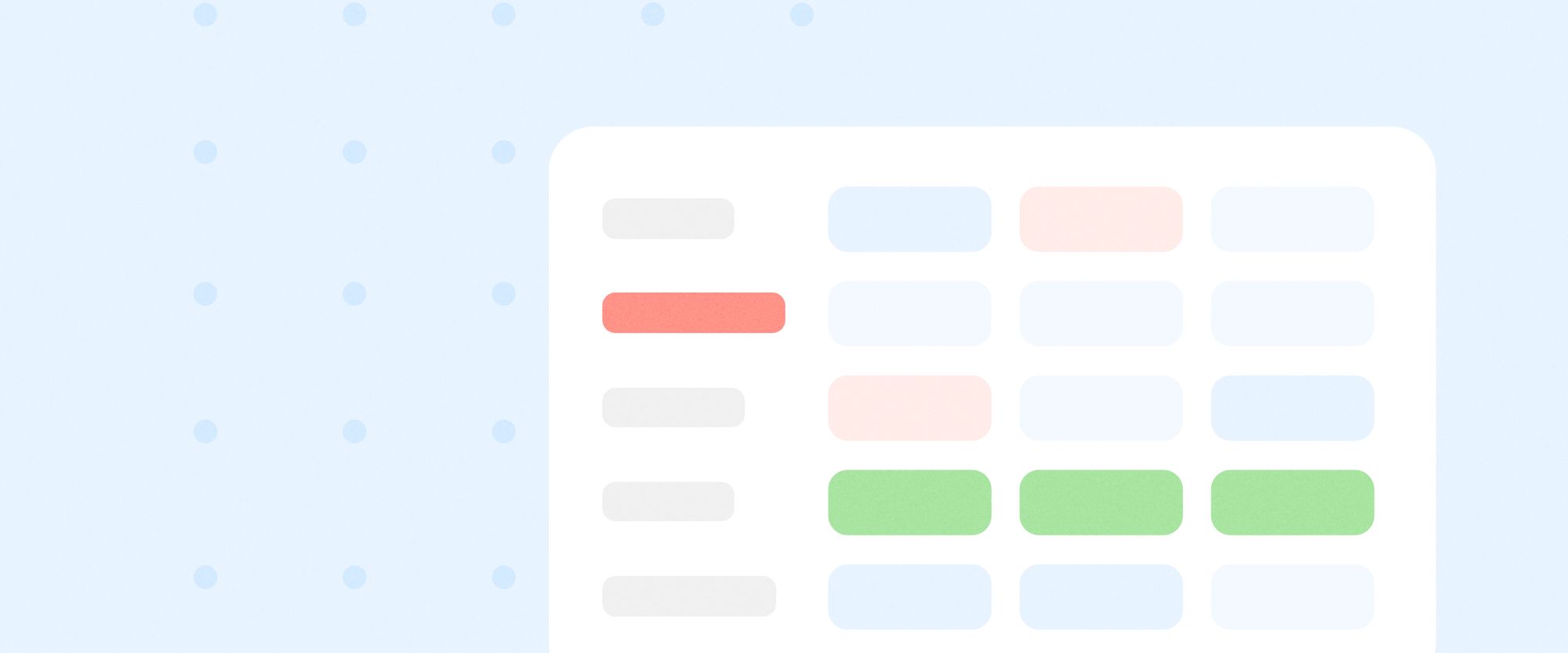

How we stack up

We’ve found that when groups look to join Dealum, a systematic way to have a holistic overview of the strengths of different systems and how they match to the needs of their group is to assess them across two focus areas: membership & funding. Below is an example of this framework comparing the three aforementioned platforms.

Reading the table:

• red - not available

• yellow - basic functionality

• green - advanced functionality

This table can be amended to cater to more systems, different evaluation criteria and scorecards.

Hearing from a customer who has used all three systems

What impact has Dealum made to your processes and how does it compare to previous systems you’ve used?

Our processes are now much more efficient and faster and we are starting to require less admin time which is a trend which will increase as we all become more experienced with the platform use. We have previously used both Proseeder and Gust and there is no comparison really….this is a far superior and more intuitive system.

— Jackie Waring, Investing Women

Want to see Dealum in action?

See how Dealum can take your investor group to the next level

Request a demo