Angel investing is never static. As markets shift and technologies evolve, so do the factors that influence which startups get funded. From round maturity to sector trends, here’s what’s hot, what’s not, and what actually converts interest into investment.

The Angel Capital Association’s recent analysis of over 12,000 fundraising applications submitted on the Dealum platform reveals just how much the funding landscape has evolved, and what factors make a difference. In Part 1 of their “What’s Hot and What’s Not” series, ACA highlighted that overall funding rates dropped sharply in 2023 (to only 4.3%) before recovering to 7.3% in 2024. The data shows a clear trend: the more mature and validated the startup, the higher the odds of funding. Series C rounds were funded at a rate of 16.4%, compared to just 3% at the Pre-Seed stage. Similarly, companies already incorporated and with prior funding, lead investors, or accelerator experience were more likely to close a deal.

Go-to-market focus also matters: B2G and B2B models saw significantly higher funding rates than B2C startups, likely due to more predictable revenue streams and lower customer acquisition risks. Interestingly, higher valuation correlated positively with funding success, possibly due to underlying maturity rather than inflated pricing.

In Part 2, the ACA explored how geography and sector impact funding odds. Despite assumptions about innovation hubs, startups in the Northwest U.S. and smaller states like North Carolina and Alabama outperformed those in California or Texas. Even in Canada, lesser-known regions like Alberta had far higher funding rates than Ontario. On the sector front, Energy & CleanTech stood out with an 18% funding rate, while consumer-facing industries and some health tech areas struggled. Surprisingly, hardware companies outperformed software when it came to funding success, even if software has delivered better exit multiples historically.

Technology trends revealed even more surprises: AI, although the most frequently cited tech, had only a 3.8% funding rate – lower than more niche areas like smart grid tech or battery storage. The type of exit strategy also influenced outcomes, with company buyouts faring better than IPO aspirations. Across the board, the key takeaway is that investor interest is shifting toward tangible traction, lower risk, and realistic returns.

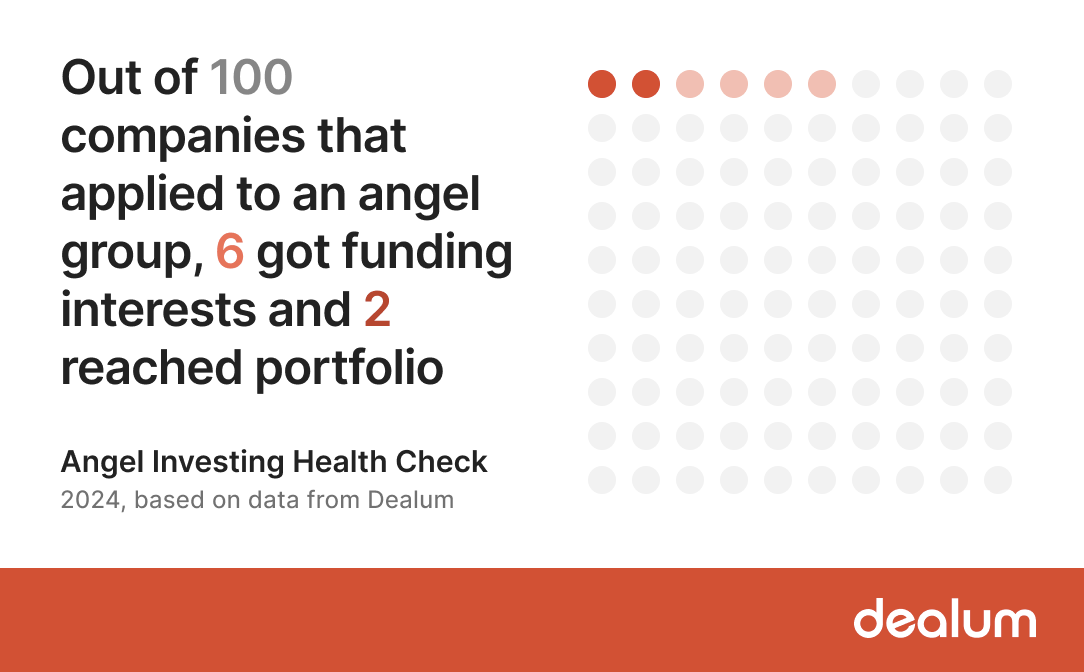

These insights mirror what we see in our data at Dealum. Out of every 100 companies that apply to an angel group on our platform, around 6 generate funding interest, and just 2 make it into a portfolio. But when it happens, it happens fast: the median time from application to investment is just 37 days. This reinforces the value of early validation and strong preparation when entering a deal flow process.

For founders, this means the path to funding is not only about timing – it's about readiness, relevance, and realism. For angels, it's a reminder that data-backed pattern recognition can be a powerful ally in navigating uncertainty and surfacing the most promising opportunities.

Read more from the ACA blog: Trends in Funding Rates – What’s Hot and What’s Not Part 1 and Part 2.

Curious to learn more about angel group operations?

Unlock the secrets to running a successful investor group with our free in-depth guidebook “Best Practices of Angel Investing”

Read now