Dealum’s funding feature is one of the most powerful collaboration tools on our platform that has a lot of complexity hidden under the plain-looking surface. In the jargon of the Dealum platform, the funding round represents the deal-specific space that in some regions is also known as the deal room (which on our platform, sometimes confusingly, is used to describe the group-specific collaboration space). Here’s your guide to understanding how the funding tab works and what can be done with it.

The two types of ‘Funding’

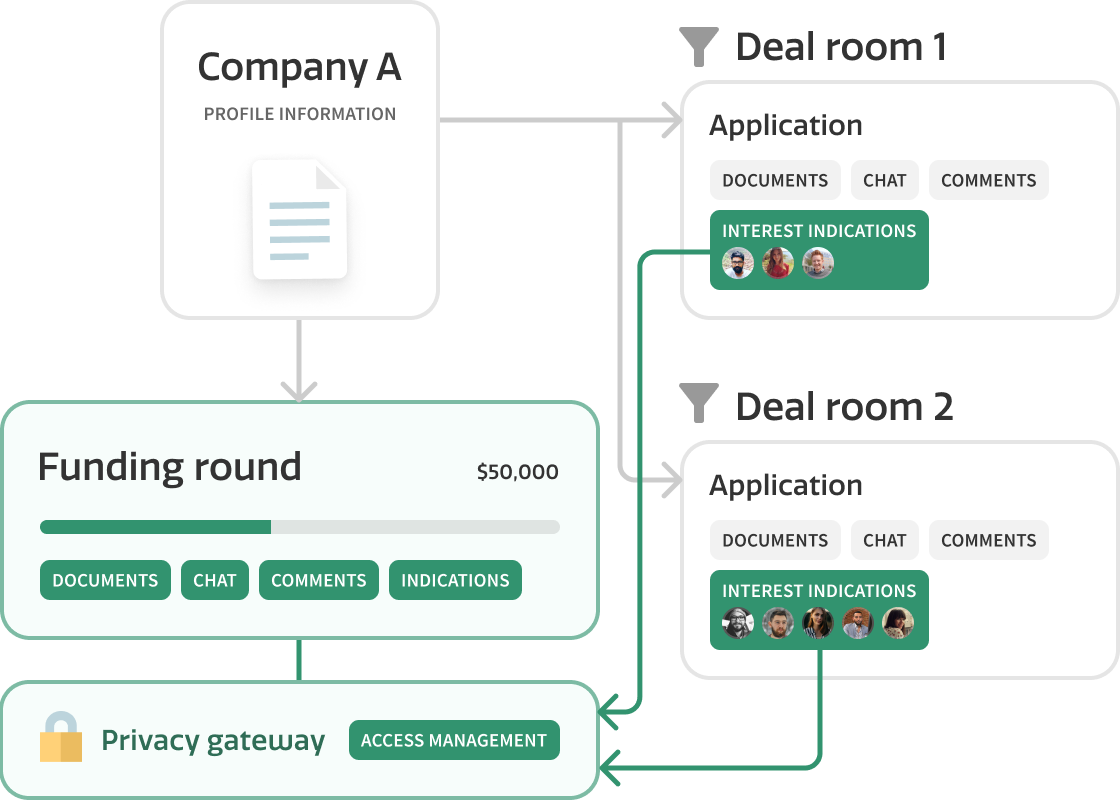

The most important aspect to note is that the ‘Funding’ section on the company profile can show two slightly different views depending on the status of their round. Whenever a company applies to your deal room, the ‘Funding tab’ with basic, simplified functionality is available on their application that allows you to collect initial interest indications from your deal room members. This may be sufficient if you only want to have a centralised overview of interests within your group and keep the communication and feedback visible to all deal room members who can view the companies in the funnel.

You can think of the basic funding tab similarly to Notepad - it works great to gather short, uncomplicated pieces of information in one place. But sometimes, you need more and reach to Word (or any other word processing software of your choice). If this is the case then on Dealum you would click on the ‘Create funding round’ button adding more power to the funding feature. ‘Funding round’ can be created by deal room admin, a member belonging to a group with the respective company access level, or the company itself if such right has been given to them in the application settings.

Funding round opens up a lot of additional functionality for in-depth management of the round and interest indications, such as:

- funding round can be shared with other deal rooms on the platform

- funding round information can be made visible to the company

- other investors can be invited to join the round with a link to the round summary page (to see the information, the investor must have a user account on the platform)

- you can set up detailed access to round info

- the round can be made private with only round participants seeing the information

- one or multiple round leads can be added (e.g. lead can be a deal room, a user, and the company itself) who have additional rights to manage the round info

- round-specific comments, documents, and company chat section is created which can be walled off from non-participants in your deal room but are shared with other participating deal rooms

- more details on the round can be added, e.g. type of funding

When the funding round is created then the funding tab limited view will be replaced with the funding round full view. The existing interests will be automatically transferred to the new view. If you have set the round to private then non-participating deal room members will not see the interests table anymore - in order to access the round information, they must request access. The level of details they will see when approved for access depends on the round setup - e.g. are participants allowed to remain anonymous and can they see each others’ names or contact details.

How the sharing works

This is going to be rather technical, but bear with us - in order to understand the access and sharing in detail, we need to explain the mechanism behind it.

The funding round that you created is linked to the company application in your deal room. This means two things - first, for each new round, the company must submit a new application to keep rounds clearly separated. There can be several applications (with or without funding rounds attached) from the same company in the deal room funnel at any time. Applications refer to each other so it’s easy enough to see and investigate the historical application data behind the company.

Second - when another group joins the round, a separate company application is automatically created in their deal room. This is the reason why an investor who is not a member of any deal room on the Dealum platform can’t join the round - with only a user account, they wouldn’t have any place to store the application. They must create their own private deal room (deal room with basic functionality is free of charge) where the application would then be created. The mechanism of “Join the funding round” is very similar to the “Add to my deal room” button if you look at it from this perspective. Most commonly, the company application will be created in the funnel inbox step (depending on the deal room settings).

The reason behind separate applications connected to one central funding round is to allow detailed privacy and access settings and gating the information, as visible in the infographic below. Different deal rooms can collect their member interests privately on the application and only make the consolidated deal room total visible to participants from other deal rooms (or to non-participating members of your own deal room if the round is in private mode). This means that regardless of the privacy settings of the deal room that initially created the funding round, you as the group manager can protect the privacy of your investors. It’s important to note that funding round leads (including the company, if made lead - more on this below) will have access to all the details irrespective of deal room-specific settings.

Using the shared funding round

When creating the funding round, a new set of communication channels (comments, company chat, documents section) is added to the funding section - chat and documents buttons under the progress bar at the top and comments at the bottom of the page, under the interests table. These are separate from the general application-related comments, chat, and documents that are visible to all members of your specific deal room who have access to the company applications in that funnel step (unless round is marked private). Application comments, chat and internally shared application documents can be found from separate tabs and chatbox on the company application. Funding round communication is shared with all participants, except participant comments which are never shared with the company. There is also an opportunity to send an email to all funding round participants and a separate activity log for the round.

When the funding round is marked ‘closed’ then no more interests can be added, but participants can still share and sign documents, comment and chat with the company.

It’s important to note that the company profile information presented to the shared round participants can differ. As explained earlier, each participating deal room will have its own copy of the company application in the funnel and only answers to questions set up by the deal room admin will be shown to members of that specific deal room. This can lead to a situation where participants come from a slightly different context - e.g. one deal room has detailed questions on market and team, the other has focused more on traction and financials. The answers to the same questions will be identical as these are automatically updated in all deal rooms when the company edits information on their profile or any other application (unless the deal room admin has locked the application or the company has revoked access to updates from the deal room).

Company involvement

A useful and less known feature that comes with the funding round is that the company can be given access to the round info to get them more involved and give a more transparent overview of the progress. The company can be given either observing access with limited visibility of information or made the round lead with a full set of rights to manage the round. Even if the company is leading the round, participant comments are still private to investors and are not be visible to the company. To automate the process further, the deal room can be set up in a way that whenever a company submits an application, they can or have to create a company-led funding round. This can be useful if the company is coming with pre-existing commitments from other investors.

And much, much more...

Hopefully, you now have a better high-level understanding of the principles of the ‘Funding’ tab on Dealum. There is a lot more to discover about the available functionality and our Help centre is a great place to go for more information and guidance. Some of the resources we can recommend starting with are:

- Giving a round participant lead rights

- Allowing companies create a funding round when applying to the deal room

- Allowing members to hide their name and/or amount from other members when marking funding interest

- Funding rounds video tutorial